north dakota sales tax nexus

In North Dakota when do you have to charge sales tax. After June 30 2019 those remote sellers may cancel their North Dakota sales and use tax permit and discontinue collecting North Dakota sales tax.

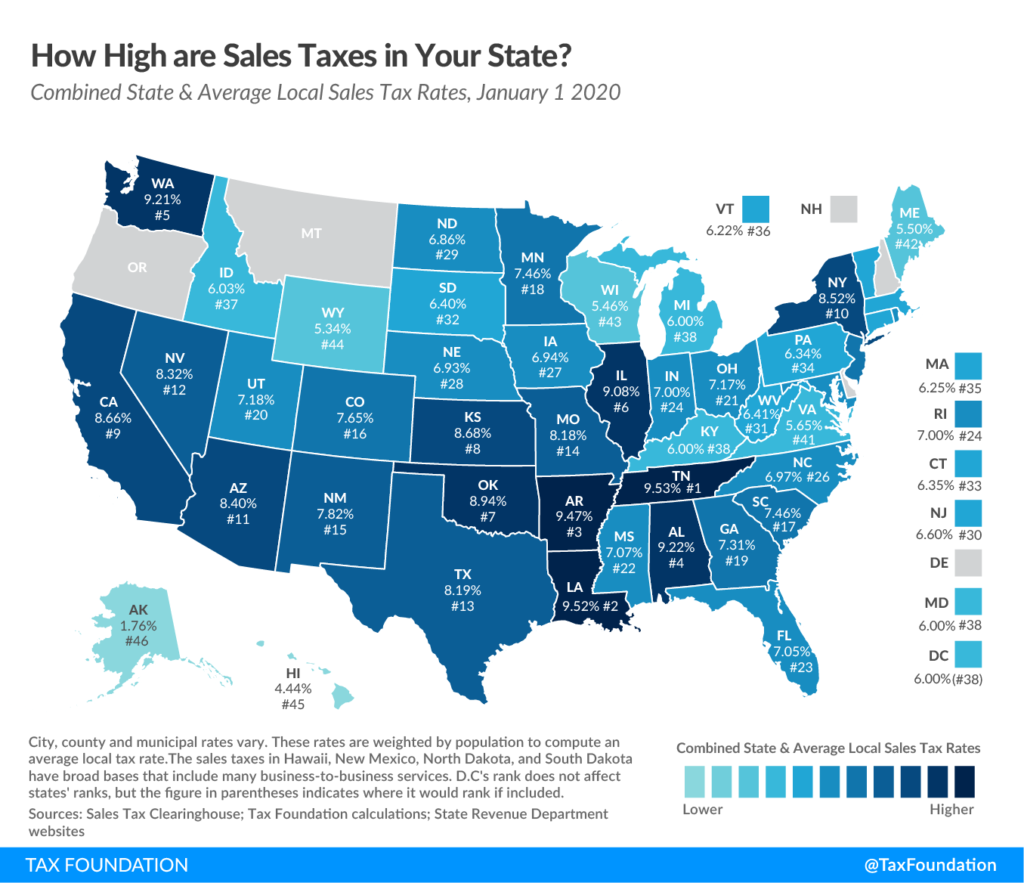

State Sales Tax Rates Sales Tax Institute

Sales Tax Nexus in North Dakota.

. North Dakota sales tax is comprised of 2 parts. State Sales Tax The North Dakota sales tax rate is 5 for most retail. Out of state sales tax nexus in North Dakota can be triggered in a number of ways.

Understand how your online business can be exposed to tax risk. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the second quarter of. There are additional levels of sales tax at local jurisdictions too.

North Dakota has a destination-based sales tax system so you have to pay. You can read about North. 35250 Plus 355 of Amount Over 25000.

The state of North Dakota levies a 5 state sales tax on the retail sale lease or rental of most goods and some services. This now leaves only the 100000. Of note the North Dakota Governor eliminated the 200 transaction sales tax economic nexus threshold effective March 14 2019.

In different states the term sales. Our free online guide for business owners covers North Dakota sales tax registration collecting filing due dates nexus obligations and more. The state-wide sales tax in North Dakota is 5.

If your business has an office or any other. Local jurisdictions impose additional sales taxes up. NORTH DAKOTA SALES TAX NEXUS.

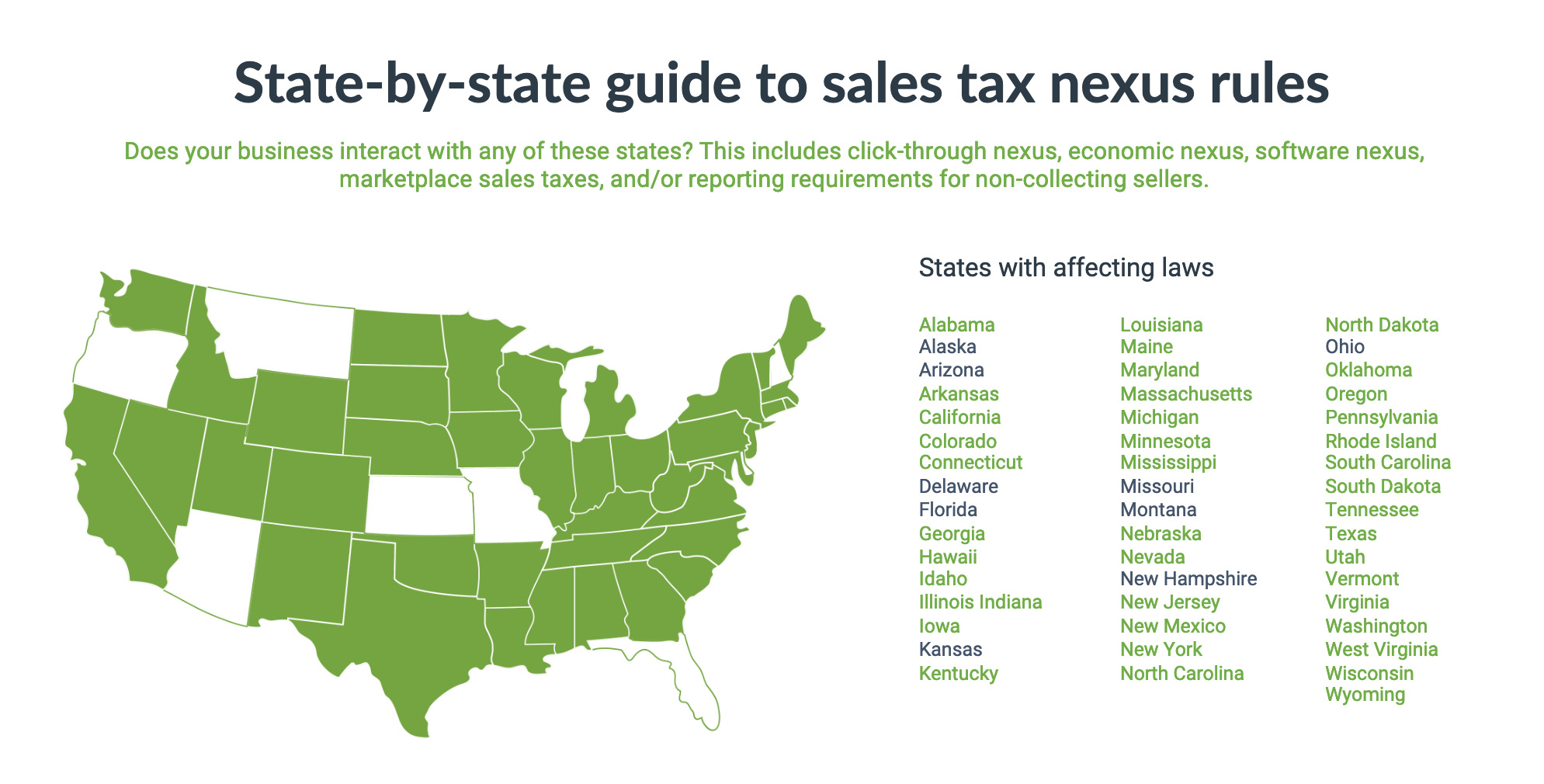

If a corporation elects to use. Nexus Questionnaire 2022 Request for Copies of Tax. 53 rows Every state with a sales tax has economic nexus requirements for remote out-of-state sellers following the 2018 South Dakota v.

141 of North Dakota Taxable Income. 1240 Plus 431 of Amount Over 50000. Effective October 1 2019 North Dakota has enacted marketplace nexus provisions.

The businesss primary location. The sales tax is paid by the purchaser and collected by the seller. The rate on farm machinery irrigation equipment farm machinery.

The general sales and use tax rate and the motor vehicle excise tax rate was increased from 55 to 6. Nexus info for your states here. You will have to comply with the state of North Dakotas individual sales tax laws and apply for a sales tax permit if.

Every state has a slightly different definition of sales tax nexus and when online sellers need to charge sales tax. So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you would charge sales tax. Marketplace facilitators without a physical presence in North Dakota are.

If your business has a sales tax nexus in North Dakota you must charge sales tax. Skip to main content An official website of the State of North Dakota. One of the foundational court cases regarding sales tax nexus Quill Corporation v.

Wednesday September 14 2022 - 0900 am. In addition to the North Dakota sales tax rate there may be one or more local sales taxes and one. According to the law of North Dakota all retailers who have tax nexus can be defined in several different ways.

Skip to main content Sales 877-780-4848. North Dakota took place in North Dakota in 1992. North Dakota is a destination-based sales tax state.

North Dakota enacted a general state sales tax in 1935 and the rate has since climbed to 5. Skip to main content. Search for forms for a variety of tax types in North Dakota.

What Does The South Dakota Vs Wayfair Inc Ruling Mean For Your E Commerce Business

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

South Dakota And Grocery Sales Tax Sales Tax Data Link

Sales Tax Nexus Trial South Dakota V Wayfair Lancaster Cpa Firm

U S Supreme Court Overturns Physical Presence Test Giving States Authority To Collect Sales Tax From Remote Sellers Butler Snow

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook

Sales Taxes In The United States Wikipedia

Free Fully Integrated Automated Tax Calculation Prodigy

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V Wayfair That Much More Imperative Tax Foundation

South Dakota S Marketplace Facilitator Sales Tax Law Explained Taxjar

Argument Preview Justices To Reconsider Sales Tax Collection In Internet Era Scotusblog

South Dakota V Wayfair What Does It Mean For Sales Tax Going Forward Greenwalt Cpas

Economic Nexus By State For Sales Tax Ledgergurus

Economic Nexus And The Future Of Sales Tax Avalara

How To Register For A Sales Tax Permit Taxjar

North Dakota Sales Tax Rate Changes January 2019

State Sales Tax And Corporate Income And Franchise Tax After Wayfair Wagner Tax Law